co-written (with authors S. Lang and J. Bedenian) as a final project for my Global & Multicultural Audiences and Stakeholders course. This was a fun one (for me) as it combined my love of coffee and Italian culture. As someone who’s lived in Italy for a few years, I witnessed the reactions to Starbucks “invading” the peninsula, so it was interesting to pivot perspectives and try to see how Starbucks could hypothetically carry out their expansion.

Executive Summary

Starbucks is well-known as an international coffee brand, but it has yet to take a firm foothold in Italy having just opened its first coffee house there in 2018. Since then, the coffee giant has opened almost a dozen stores, but its presence in Italy still pales in comparison to other European nations largely because Italian culture is resistant to a big brand, American coffee option. This is not without reason; Italy is the third largest consumer of coffee in Europe, and coffee drinking habits are tied to Italian tradition making it difficult for foreign brands to establish themselves successfully.

Our objective is to expand the presence of Starbucks in Italy by educating Italian consumers about the environmental and economic benefits of new Starbucks stores and changing their perception of the brand to accept it as a high quality, Italian-inspired coffee option. Since Starbucks already has more of a presence in the northern cities of Milan and Turin, we will focus on bringing the brand to the city of Bologna and the southern city of Naples. Bologna is a college town filled with millennials who are more likely to accept non-local coffee. While Naples is a more traditional city, millions of visitors pass through its ports each year and offer a good opportunity to appeal to a more international audience.

We will begin with a month of research in both cities to gauge the knowledge and perception of Starbucks then utilize that data to develop a targeted campaign for each city. We will create newspaper ads, social media posts, and a TV commercial that appeals to our key audience and track engagement of the campaign with SEO. After three and six months, we will conduct additional focus groups and surveys to track how the perception of Starbucks has changed with the end goal of seeing enough positive change to build permanent stores in both locations.

Background and Situational Analysis

Introduction: Starbucks in Italy

“We arrive with humility and respect in the country of coffee” — Howard Schultz, former CEO of Starbucks.

It was in September 2018 that Starbucks did what was previously considered taboo: it had opened their first coffeehouse in Milan, Italy. Located inside the historic 25,000 square foot Poste building in Piazza Cordusi, it was not just any average Starbucks Coffee. The first of its kind in Europe, the Milan Reserve Roastery is meant to be an upscale experience. It features unique elements in addition to specialized blends of coffee beans, which include a bakery (headed by artisanal local baker Rocco Princi) and cocktail bar.

According to the company, it was “the theatre and romance” of Italian coffee bars that inspired Starbucks in the 1980s (Starbucks celebrates one year in Milan 2019) and the thoughtful and intentional design choices reflect this. Marble was imported from quarries in Tuscany, beautiful Scolari coffee roasters, palladiana floorings and traditional Italian architectural motifs pay homage to the country of coffee and to the city of style and design that the Roastery finds itself in (2019).

The Roastery’s opening created nearly 300 jobs in Italy. Additionally, while collaborating with Fondazione Don Gino Rigoldi and La Scala Academy, Starbucks brought its Apprenticeship Program to the Milan location.

“As of the first quarter of 2021, Starbucks had 2,509 stores in Europe;” the majority of which are located in the United Kingdom with 748 stores (Europe: Starbucks, per country 2021). In Italy, there are currently 11 stores open, concentrated in two northern cities, Milan (which includes the Roastery), and Turin.

“As an Italian myself, I grew up with only one concept of coffee – and that’s espresso,” said Giampaolo Grossi, general manager of the Starbucks Reserve Roastery Milano. “It’s been a privilege to share a whole new coffee experience with our customers here and to watch them discover who we are at Starbucks. Whether it’s ways to brew and taste coffee or a beautiful environment where they can sit, relax and connect with friends, we aim to offer an experience that is unexpected and new, while at the same time somewhat familiar.” (Starbucks celebrates one year in Milan 2019).

Brief History and Regional Divides

Italian history covers a little over three millennia, including events such as the rise and fall of the Roman empire and the Renaissance to name a few. An important detail to note is that before its complete unification in 1870 to make up what we now know as modern-day Italy, rule was left to the level of the city-state. Each of these city-states were regions ruled by major cities, run by either elected leaders or ruling noble families. This relatively recent achievement of national unity drew regions of fundamentally different people together, creating a divide between northern and southern Italy in particular.

The transatlantic economic boom following World War II reached northern Italy and intensified the differences between the north and south. Southern Italy in particular, became a “country of emigration” and more than 2 million southern Italians moved to northern Italy or to foreign countries. It can be said that the North is generally thought of as industrialized, fast-paced, efficient, and colder in terms of weather and people’s approach to personal relationships. It is considered to be more “European” or cosmopolitan than other parts of Italy. The South is considered more laid-back, intensely tied to older traditions/superstitions, but is also sometimes tied to stereotypes of mafiosi and cheaters.

The main takeaway is that although a united country within geographic borders, Italy should be considered a mosaic of histories, languages and cultures fused together.

Hofstede’s Insights- Italian Cultural Dimensions

Italy’s various regions also make up for paradoxes in the 6 dimensions laid out by Hofstede: power distance, individualism, masculinity, uncertainty avoidance, long term orientation and indulgence. Understanding the basic essence of where Italy scores out of 100 within these dimensions will lead us to a better appreciation for reaching Italian consumers.

Power Distance (50): This dimension truly shows the differences between Northern and Southern Italy. Northern Italians prefer equality, and any control or formal supervision is usually not looked upon favorably, especially among the “younger generation, who demonstrate a preference for teamwork and an open management style,” whereas in Southern Italy, many Italians have the opposite tendencies (Hofstede 2021).

Individualism (76): Italy is an Individualist culture, and this correlates especially in the “big and rich cities in the North, where people can feel alone even in the middle of a big and busy crowd,” whereas the South still varies within this dimension because of its tendency to perpetrate a more traditional approach, including the importance of the “family network” and social aspects and rituals such as big weddings, Sunday lunches, and other familial obligations. It has been often noted and reflected in popular culture that many migrants from the southern regions find their reception and approach to relationships “less warm” in comparison to what they are used to (Hofstede 2021).

Masculinity (70): Having a high score within this dimension indicates that a culture/society is “highly success-oriented and driven.” Being competitive and assertive are values that are instilled at an early age, and throughout their lives, Italians like to show their success with status symbols (Hofstede 2021).

Uncertainty Avoidance (75): As a culture, Italians rank high in uncertainty avoidance, which means they do not find comfort in the unknown or ambiguous. For its highly bureaucratic society, where formality and civil codes are filled with complicated details and clauses, Italians surprisingly do not always comply with them, but in general, Italians are planners. This paired with their high score in Masculinity make Italians tense and to release that, Italians crave good times, or la dolce vita, in the form of relaxing moments in the everyday, such as “long meals and frequent coffee breaks.” (Hofstede 2021).

Long Term Orientation (61): A score like this makes Italy a pragmatic society, which means that Italians tend to accept that “the truth” depends very much on context and time. They are adaptable to changing conditions, and usually show an intense sense of perseverance and being thrifty.

Indulgence (30): Despite cultural stereotypes, Italy’s low score indicates that it is a culture of Restraint, meaning that they often “control the gratification of their desires.” While la dolce vita is emphasized abroad, Italians tend to be cynical or pessimistic as they see their actions being restrained by social norms.

Reaching the Italian Consumer

Quality is key: Italians as a whole demand and expect quality products. They traditionally have been concerned with the quality of a product or customer service significantly more than about sales or promotions. If available, they trust and prefer products ‘made in Italy’, however foreign products are also stylish, specifically in the realms of the fashion sector, where “novelty is welcomed.” While villages and smaller towns focus on small businesses and local products, consumers in big cities do purchase from mass retailers and larger chains (Santander 2021).

While they are historically loyal to their domestic brands historically, recently consumers, particularly younger, have become more interested in trying new products/brands, especially if they have intriguing promotions. This is due to the recent re-organization of their “shopping habits to meet economic constraints,” which were affected by both the 2008 financial crisis and most recently the coronavirus pandemic—however: “consumer confidence has been increasing since the second half of 2020,” because of the loosening of lockdowns and pandemic restrictions (Santander 2021).

Coffee Culture in Italy

Italians often act as if they invented coffee, and in a way, they did- at least when it comes to espresso. Coffee was introduced in the country in the 17th century. Italy’s original coffee houses date back to the 1700s like the famous Antico Caffè Greco (opened in 1760) in Rome where Keats and Byron sipped at the marble tables. Established in 1720, Caffè Florian is the oldest continuously operating coffee house in Italy and oldest in the world, serving customers in Venice for three centuries.

In these original coffee houses, the coffee was brewed “in the Turkish style, which took about five minutes to prepare” in addition to the time it had to cool down enough for patrons to be able to enjoy it (Kovick 2020). Despite the stereotypes against Italian efficiency, a need arose for a more productive and swift system. Enter the espresso. The name comes from the Italian verb esprimere, meaning to express or press out, which aptly describes the brewing method in which pressure is used to make what many consider the purest, concentrated of coffee. Espresso became extremely popular because without burning coffee grounds or watering them down, it does the least damage to the grounds, giving them the ability to maintain their flavors.

The Italian Market

Italy is the third largest coffee consuming country in Europe, accounting for 11% of the total European coffee consumption in 2017, which included “151 thousand tons of green and instant coffee” (Coffee market in Italy- Statistics and Facts 2019). Although it is not the highest consumption rate among the continent, Italy’s per capita rate is “still above the European Union’s average of 5.2 kg per year” (2019). Lastly, an important detail to note: independent cafes make up more than “90% of the Italian market, with a very small share of International chains” (2019).

Competitors

While Illy and Lavazza dominate as the top Italian roasting companies, or torrefazioni, it is interesting to see where the Italian roasting companies are concentrated. It is in southern Campania that we find not only the largest number of coffee roasters, but immensely popular brands such as Kimbo and Motta coffee. In second place is Emilia Romagna with seven roasting companies such as Molinari, and in third place is northern Piedmont with six roasting companies, which include the world-famous coffee brands Lavazza, Vergnano, and Bialetti.

| Regione | Numero torrefazioni | Marche di caffè |

| Campania | 21 | Aloia, Borbone, Passalacqua, Kimbo, Lollo, Toraldo, Kosè, Moreno, Izzo, Karoma, Giusto, Fiore, Harom, Janeiro, Kenon, Quito, Bonelli, Gioia, Rionero, Motta, Sophia |

| Emilia Romagna | 7 | Molinari, ABCcaffè, Esse, Musetti, Kavè, Cagliari, Krifi |

| Piemonte | 6 | Lavazza, Costadoro, Vergnano, Rossini, Bialetti, Splendid |

| Veneto | 6 | Segafredo Zanetti, Pellini, Vero, Carraro, Goppion, Vescovi |

| Lombardia | 6 | Caffitaly, Agostani, Hardy, Juba, Poli, Lui |

| Marche | 4 | Saccaria, Ottavo, Janus, Pascucci |

| Sicilia | 3 | Moak, Barbera, Torrisi |

| Friuli-Venezia Giulia | 3 | Illy, Caffè Trieste, Hausbrandt |

| Calabria | 3 | Aiello, Guglielmo, Mauro |

| Lazio | 2 | Italia, Trombetta |

| Toscana | 2 | Corsini, Caffè Toscano |

| Trentino-Alto Adige | 2 | Gimoka, Karisma |

| Puglia | 2 | Quarta, Ninfole |

| Abruzzo | 1 | Universal |

| Basilicata | 1 | Grieco |

| Liguria | 1 | Covim |

| Umbria | 1 | Europa |

| Valle d’Aosta | 1 | Artari |

Number of coffee roasting factories in Italy per region (Marche di Caffè italiano 2019).

In addition to domestic brands, Starbucks’ most significant foreign chain competitors would be the McDonald’s McCafé brand as well as Costa Coffee. In 2019, both had “recorded… higher numbers” of locations open across the continent than Starbucks (Europe: Starbucks, per country 2021).

SWOT Analysis and Conclusion of Background

Strengths: Starbucks is essentially inspired by Italy and the Italian coffee tradition, so it wants to pay homage to it while providing its customers with a different option within the robust Italian coffee market. Starbucks is a successful, global brand with a strong CSR, and it can provide job opportunities. It is a third space that is not only conducive to work in, but it has the offer of reliable Wi-Fi, coffee and food, an offering that not many of the traditional coffee bars or pubs can boast. Additionally, the younger generations of Italians are aware of Starbucks from their times abroad, from movies and television. Just as other cultures dream of emulating the Italian ideal of “la dolce vita,” being able to participate in the American Starbucks way can be seen as some sort of trendy or cool phenomenon, just because it is foreign.

Weaknesses: Starbucks does have higher prices than coffee offerings available to the average Italian consumer. It is also easy to imitate most of the offerings that Starbucks provides- meaning, if they wanted to, coffee bars around the country could potentially provide their own imitations of frappuccinos.

Opportunities: Opening new Starbucks locations in different cities gives the brand a chance to continue collaborating with local businesses (for example: The Milan Roastery’s partnership with local pastry chefs) and provides job opportunities for locals. It also gives Starbucks the opportunity to celebrate the Italian coffee tradition, paying homage to it in the country of coffee.

Threats: The low cost of traditional competitors, the potential of other global competitors (such as McDonald’s Café or Costa Coffee) being able to imitate and perhaps oversaturate the “international chain” market, and the strong cultural ties are among the biggest threats to successfully opening new locations.

To conclude our background and situational analysis: Italy has a well-established coffee tradition, however, the younger generations who have had the opportunity to not only travel abroad and experience the novelty of Starbucks in other countries, but embrace the idea of a third space, especially now as the pandemic has emphasized the probability of remote regular work in some sectors. Just as the innovative Italians of the 1700s saw a need for a quicker way to prepare coffee, some Italians of today recognized that need for a third space (particularly with reliable Internet). Additionally, while people may travel to Italy to experience something different than the Starbucks they may be accustomed to back home, it is a globally recognized brand– often known for providing a brief space of refuge for tourists in the forms of Wifi, air conditioning, and familiarity in perhaps a foreign place.

Italy can continue this new wave of caffeinated innovation by expanding its coffee choices for its consumers. This need does not undermine or diminish the strong culture Italy has surrounding its coffee bars and the quality of their products. Because Starbucks has a deep admiration for the Italian coffee tradition, we believe there is a respectful way to effectively proceed with the expansion of the brand to cities beyond Milan and Turin.

Statement of Purpose

Our goal is to further expand Starbuck’s presence in Italy. We plan on expanding by celebrating and recognizing Italian coffee culture and acting as a part of it as opposed to overtaking it.

Objectives

Based on our research, Italians tend to have a negative opinion or hesitancy towards Starbucks which has prevented the company from expanding. This stems heavily from the perception that Starbucks is an American, big-brand corporation that provides a lower quality coffee experience than Italians prefer. In order to expand Starbucks’ reach in Italy, we must first accommodate the opinions and lifestyle of the population and blend the Starbucks brand with Italian culture. Therefore, we propose two main objectives for our campaign:

- Reposition Starbucks as a high quality, Italian-inspired coffee brand to encourage a more positive perception of Starbucks among Italians.

- Educate Italians about the economic, environmental and cultural benefits of Starbucks’ presence in Italy.

Target Audience and Rationale

We identified two key target audiences for our campaign: millennials and tourists. The northern city of Bologna is a college town where millennials are abundant, and they tend to be more open to new ideas. The typical age of Italian millennials is 24-40 and is more skilled and educated than those in previous generations. However, most millennials are not completely financially independent, and many still live with their parents which has earned their generation the unfortunate nickname of bamboccioni, meaning “big babies” (Martens Center for European Studies). This is not an entirely fair designation because millennials have endured two major economic hardships in their lifetime: a recession in the early 1990s as well as the economic crisis of 2008. Recently, the coronavirus has continued negatively impacting Italy’s financial welfare. Each of these situations has made it difficult for millennials to achieve financial independence, but this does not stop them from spending and enjoying life.

As noted in our Hofstede analysis, Italy traditionally ranks lower for indulgence and is known as a culture of restraint. Italian millennials are shifting that behavior, and they are more interested in spending money (to some extent), going out and moving at a faster pace than older generations. As consumers, they value sustainable products that have good quality and design. They are interested in learning about the production and ingredients that go into their goods, and they enjoy brand name items. From a media consumption perspective, Italian millennials prefer to use social media apps on their personal devices rather than staying up to date via traditional media like newspapers and television. In summary, Italian millennials are attracted to high quality, branded products they can acquire quickly at a reasonable price.

The southern city of Naples presents a much different population. As a port city, tourist traffic is high, as many pass through on their way to neighboring tourist attractions, islands and resorts. Locals to the city are more traditional than northern Italians and are more likely to have a negative bias toward big-brand companies, instead preferring local business. Because of this, we will instead target our message to tourists passing through Naples while still respecting the traditional preferences of the local population.

Naples is the ninth most visited city in Italy, and its tourist population is growing. Most tourists are from other European countries as well as the United States and China (Italy Travel Statistics 2021). Tourists are fast-moving individuals looking for a quick Neapolitan experience during their short time in the city. They are familiar with international brands, and while they are looking for an authentic experience during their time in Naples, they also value affordable, quick products and services. Together, tourists and locals to Naples have juxtaposed interests that intersect at valuing quality and authenticity so we must position our message around these values in order to attract tourists without insulting locals.

Communication Strategy

Our plan calls for the implementation of new marketing in two cities, Bologna (Emilia-Romagna) and Naples (Campania). These two cities were chosen because of their geographic location and local culture. Bologna is a northern, collegiate city. Because we have already set up a foothold in Northern Italy, we would like to consider the possibility of a more traditional Starbucks. As seen in the background information, younger Italians are not opposed to the novelty of Starbucks. Our marketing will try to utilize this feeling, balanced with the Italian idea of “la dolce vita” to continue to expand the Starbucks’ brand in Italy.

Our second city, Naples, was chosen for a few main reasons. Firstly, Naples, while less of a travel destination than other Italian cities, is a short drive from Rome and is the gateway to both the architectural site of Pompeii, a port city for cruise ships, as well as access to the Amalfi Coast and Capri. It can provide the perfect mix of international tourists and locals. Secondly, it would be our first effort to infuse Starbucks in Southern Italy, which is noted as being more traditional and more opposed to a global coffee brand and more in favor of local shops. In Naples, we are hopeful for data that indicates that we would be able to open a version of a “Starbucks Lite” that allows us to begin to develop the Southern Italian market.

The first part of our strategy will be extensive research utilizing both focus groups and internet surveys. Any budget made for this plan will need to include approximately 130,000 euros which covers a stipend in each city for focus groups (50 euros per volunteer, 500 volunteers in Bologna and 1,500 in Naples) and 5,000 euros for survey prizes where 10 random surveyors will be given 500 euros each. Finally, around 25,000 in free coffee bean sample bags for those who fill out our online survey. Both the survey and focus groups will revolve around the following questions:

- Are you familiar with Starbucks?

- How would you describe Starbucks in three words?

- Are you interested in a Starbucks coffee shop?

- Do you like the taste of Starbucks coffee? (Focus group members will be given the opportunity to taste)

- Are you more interested in Starbucks coffee or novelty drinks?

- How long would you be willing to wait for a Starbucks coffee?

- How much would you be willing to pay for a Starbucks coffee?

- Would you be offended if a Starbucks coffee shop were to open in your city?

- What is the best way to communicate with the consumer: print, television, or social media?

The research will last one month and will be revisited both three months and six months after the communication plan implementation.

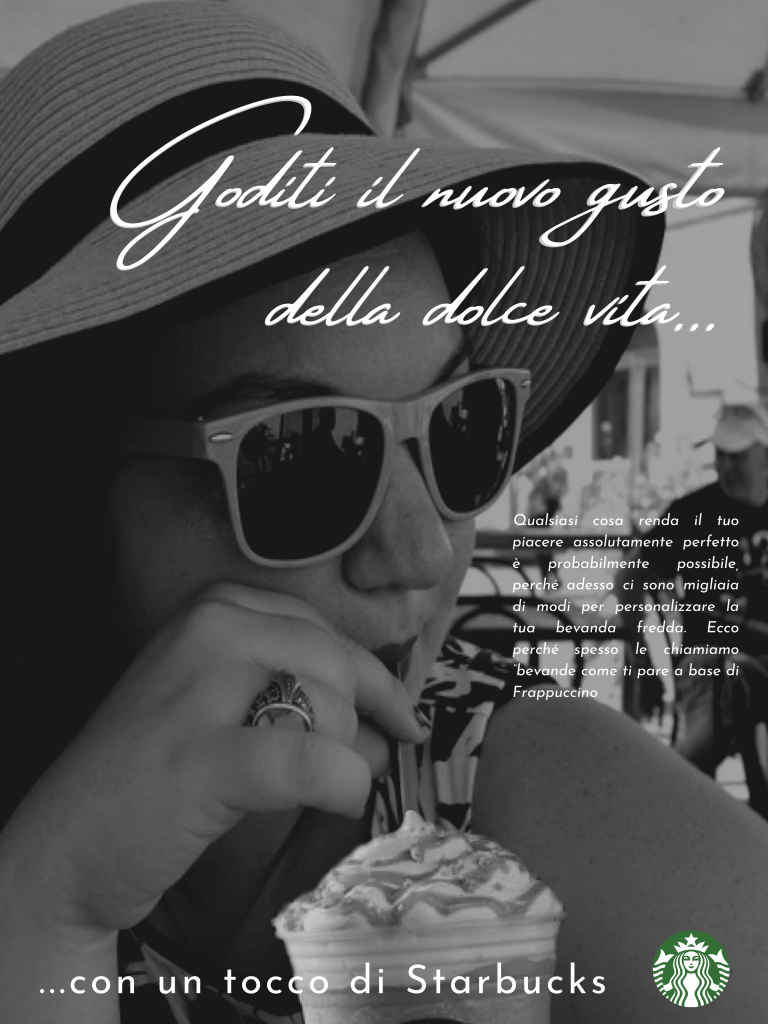

Based on these results, plans will be devised for each city. Both plans, however, will be formed around creative pieces we have designed (included after works cited). First, we will devise newspaper ads, and as many older Italians still receive most of their news from print, we plan on taking a full-page ad. One ad will include the slogan “Una tradizione Italiana, con il tocco di Starbucks” which translates to “An Italian tradition, with a touch of Starbucks” and include a picture of a traditional Italian café and a minimalistic Starbucks logo sign. Another ad will be an ode that harkens back to the luxurious “la dolce vita,” re-emphasizing the high quality of the product.

Secondly, for television, we will have a thirty second ad of our newly minted “CEO of Starbucks Italia.” Our new CEO will be an Italian citizen. Their message will be reassurances that Starbucks is not looking to remove Italian tradition from coffee but be a part of it. The message will end with an offer for a free espresso for those who fill out our online survey. The ad’s purpose is twofold; not only will we receive more survey responses, but it also allows for the Italian consumer to taste what Starbucks has to offer.

Lastly, we will utilize Italian influencers and social media. These influencers will be given tours of our flagship location in Milan and asked to taste the traditional and non-traditional coffee drinks. The hope is that they will be able to convey the flavor and similarities of Italian coffee with the traditional beverages and hype of the allure of the non-traditional beverages for those who wish to try something new. We will also design an Instagram campaign contest to boost brand visibility within Italy and encourage our consumers to interact with us. The campaign will celebrate summer in Italy and showcase the refreshing sweetness of a Frappuccino and how it coincides with the sweet life (la dolce vita).

After the first 3 months of the campaign, we will once again bring in focus group members and examine new survey results to see if there are any changes that our plan needs to accommodate. Finally, after 6 months, we will examine the growth from our research and see if building store fronts in Bologna and Naples is feasible at that time. The hope is that both cities will welcome Starbucks, either a traditional Starbucks or a specialized store that is strictly Italian style. Even if the research yields that one or neither of the cities are ready for a Starbucks, the money used for the campaign will still be more inexpensive than building and staffing new Starbucks stores and will give us valuable information for future Italian expansion.

Media/Communication Channels and Rationale

Our plan calls for three distinct communication channels: Print, Television, and Social Media. These have their own varying level of importance and will be utilized based on their effectiveness in different areas. First and foremost, despite its costs, television is the most effective communication channel and will be used in both Bologna and Naples marketing. In 2016, the Italian television ad market was worth over $6.8 billion dollars (Santander 2021). As stated, Italy is a pragmatic society, and a level of trust needs to be formed for Italians to buy a product. By using a television ad with an Italian head of Starbucks, it begins to build the trust between the Italian consumer and Starbucks.

Secondly, Southern Italians are considered to be more traditionalist, and when paired with their long-term orientation and uncertainty avoidance scores, leads to the idea that while internet and television are useful, printed media in newspapers is still needed to sell a point to consumers. According to Statista, Italy’s top ten newspapers sell more than 990,000 newspapers each month (Statista 2019). While these sales have less reach than television, it is still an effective way to reach the more traditional group of Italian consumers.

Lastly, nearly 75% of Italians have access to the internet (Central Intelligence Agency 2021), therefore, because of the reach, we should be easily able to post a survey online and reason ample results for our research phase. Additionally, nearly 40% of social media users find advertisements on social media interesting (Santander 2021). If we are able to use social media influencers to tap into the market, we can begin to switch the attitude of the Italian consumer towards embracing Starbucks into Italian coffee culture.

Scheduling/Content Calendar

The plan will take place over the spread of six months beginning in July 2021 and conclude in December 2021 and is broken down as follows:

- July 2021: Research – This first month will be used to begin the process of forming focus groups, creating a survey and gathering data.

- August 2021: Forming Marketing Plan – Based on what the data tells us, we will design plans specifically for the two cities. For example, if Bologna would like more novelty items and has a desire to be communicated through social media, we can design an Instagram post of a Le Due Torre in Bologna.

- September 2021: Initiate the plan – This month will feature all communication channels including print, television, and social media. September can be seen as the month the communication plan begins for consumers.

- October/November 2021: Monitor Marketing Strategy – As the communication plan is being rolled out, the communication team will continue to monitor the survey results and if the attitudes of the Italian consumer are not shifting, we can readjust our communication strategy.

- December 2021: Final Analysis and Next Steps – Our first step in December will be to hold another round of focus groups and continue to monitor the survey results. As the data continues to roll in, we will be able to see if opening a Starbucks coffee shop is viable in Bologna and Naples. If we find that neither city is ready to hold a store front, we can use the survey and focus group results to form a new plan to further our entry into the Italian market.

Measurement

As explained in the communication strategy, we will conduct surveys – promoted in our TV commercial – and focus groups to assess how the perception of Starbucks changes from the beginning of our campaign to the end. We will aggregate these results to see if and how much knowledge of the Starbucks brand has increased as well as the willingness to be a Starbucks consumer. We will create visual representations of our data via charts and graphs that show the changes over three and six months.

Additionally, we will track engagement with our campaign. Our outputs – the social media posts, commercials, and news ads – will be created and executed based on our timeline. We will track various SEO outtakes for the entirety of the campaign including survey participants; shares, likes and replies on social media posts; new follows and mentions on social media; searches for Starbucks and campaign related hashtags and content; and survey participants.

From this data, we will identify our outcomes. These outcomes will determine the next steps for both Bologna and Naples, and our hope is the results indicate that opening new stores in both cities would be successful.

Works Cited

Bro, S. (2021, June 7). Italy – Travel Statistics. LuggageHero. https://luggagehero.com/blog/italy-travel-statistics/.

Central Intelligence Agency. (2021, June 22). Italy. Central Intelligence Agency. https://www.cia.gov/the-world-factbook/countries/italy/.

Coppola, D. (2020, June 5). Millennials in Italy – Statistics & Facts. Statista. https://www.statista.com/topics/6439/millennials-in-italy/.

Drea, E., & Setti, A. (2020, July 20). Only its ‘big babies’ can save Italy now. Martens Centre. https://www.martenscentre.eu/blog/only-its-big-babies-can-save-italy-now/

Encyclopædia Britannica, inc. (2021, June 23). Italy. Encyclopædia Britannica. https://www.britannica.com/place/Italy.

Europe: Starbucks, per country 2021. Statista Research Department. (2021, February 23). https://www.statista.com/statistics/541629/number-of-starbucks-stores-in-europe/.

Kovick, M. (2020, October 1). The history of coffee culture in Italy. Wanted in Rome. https://www.wantedinrome.com/news/why-italians-are-obsessed-with-coffee-the-history-of-coffee-culture-in-italy.html.

Marche di Caffè italiano. CucinaGeek. (2020, June 8) https://cucinageek.it/marche-caffe-italiano/.

Santander. (2021, June). Italy: Reaching the consumer. Reaching the Italian consumer – Santandertrade.com. https://santandertrade.com/en/portal/analyse-markets/italy/reaching-the-consumers.

Skivington, K. (2021). Illume Stories – Italian Culture: A Millennial Perspective. Illume Stories. https://www.illumestories.com/2018/09/italian-culture-a-millennial-perspective/.

Starbucks celebrates one year in Milan, plans to open in more Italian cities. Starbucks. (2019, September 12).

https://stories.starbucks.com/emea/stories/2019/starbucks-celebrates-one-year-in-milan-plans-to-open-in-more-italian-cities/.

Statista Research Department. (2019, September 16). Coffee market in Italy- Statistics and Facts.Statista. https://www.statista.com/topics/4053/coffee-market-in-italy/.

One thought on “Starbucks Italia: Communication Plan for the Expansion of Starbucks in Italy”